what does liquidating stock mean

Businesses that operate in a niche market may find it challenging to sell off their current inventory quickly. Just as a company may liquidate an entire subsidiary by selling it to another firm so too may an investor liquidate by selling a particular type of security.

In many cases self-liquidating assets can go on to generate profits after creating enough return to cover that.

/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)

. What is a physical change that starts. Current assets are something that can be liquidated within a couple of weeks. Liquidation means the distributions of the Trust Account to the Public Shareholders in connection with the redemption of Ordinary Shares held by the Public Shareholders pursuant to the terms of the Companys Amended and Restated Memorandum and Articles of Association as amended if the Company fails to consummate a Business Combination.

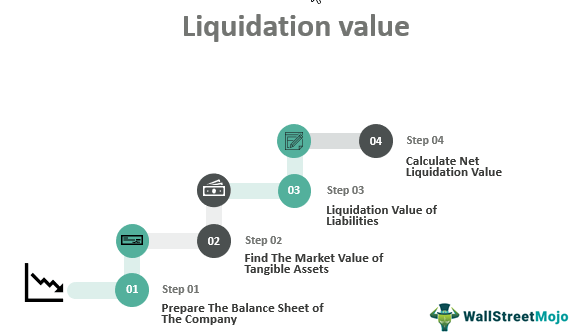

What Does Liquidation Mean for Company Shareholders. To make it usable stockholders need to sell it ie liquidate it to lock in its value. During liquidation the assets of the company get distributed among several groups and individuals.

Liquidation is the selling of assets to raise cash usually to pay off debts. Contrary to popular use the word to liquidate doesnt mean to destroy or anything similar when you talk about money. Any remaining assets may be distributed to the companys owners.

Typically those assets are the companys inventory and theyre sold at a deep discount. When a fund is up for liquidation it means that the fund company has decided to either sell off the funds assets or merge the funds holdings into another fund preferably a well-performing fund within the same fund family. In some cases inventory liquidation happens when a company is going out of business or shuttering several locations.

Important to note is that only holders of preferred stock receive liquidation preferences. It probably doesnt mean anything. You also might lose out on your stocks future appreciation which could prove costly to your long-term investment portfolio.

Any stock or inventory could be considered current assets if the business is able to sell them quickly and easily. Assets such as stocks bonds. The liquidation level normally expressed as a percentage is the point that if reached will initiate the automatic closure of existing positions.

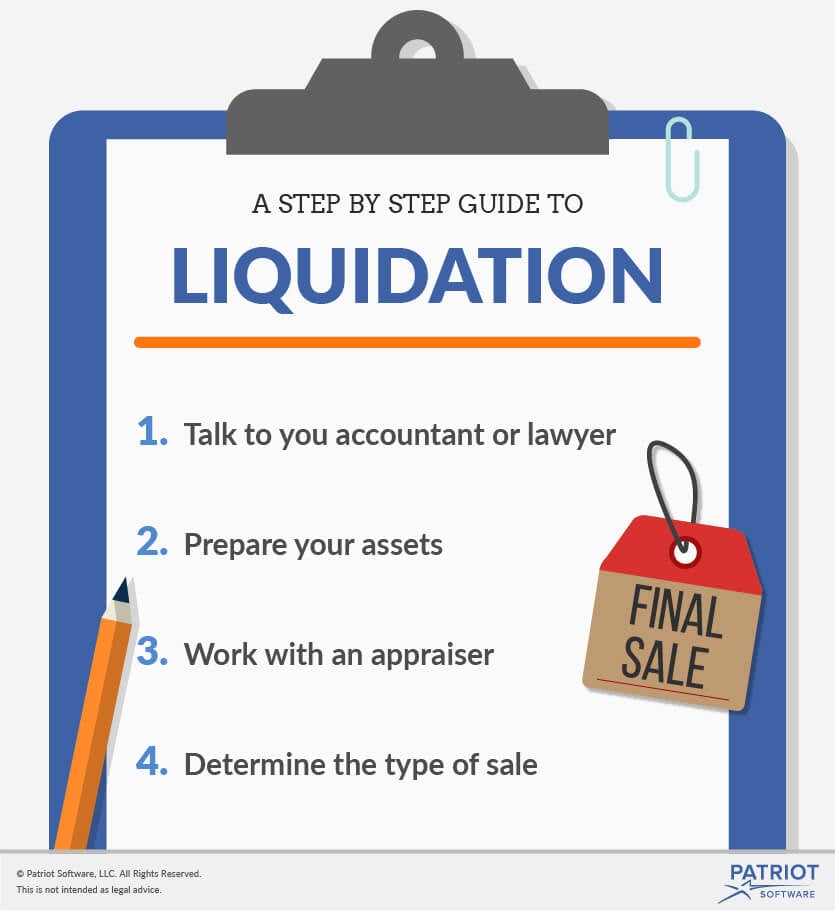

Liquidation is the process of ending a companys business and dissolving the company. In most instances stock liquidation occurs when shareholders sell their shares on the open market for ready cash. Read on to learn more about the liquidation process.

The conversion of assets into cash. Liquidating a house for example would mean turning. For most stocks traded on major exchanges the net asset value or NAV is either the same as the net liquid value -- the NLV -- or very close to it.

Before selling you should consider the financial consequences of liquidating. For other companies liquidation is a constant and ongoing event in which consumers can purchase used or repaired retail items at a fraction of the cost. They are most commonly set at 1X meaning that investors would need to be paid back the full amount of their investment before any other equity holders.

The selling of assets and the paying of liabilities in anticipation of going out of business. Liquidation in most cases is part of closing down or restructuring a business. A liquidation specialist at a brokerage firm can help you anticipate the tax consequences when you liquidate stock and advise you about an approach that will maximize.

Once the insolvent company has gone into liquidation the insolvency practitioners primary task is to pay creditors what they are owed from any monies realised. In the context of cryptocurrency markets liquidation refers to when an exchange forcefully closes a traders leveraged position due to a. Liquidation is the process of turning assets into cash.

Self-liquidating is a term that is used to describe any investment in which the acquired stock bond property or other holding has the inherent capability to offset the expense that was incurred in order to acquire the asset. Shareholders will receive nothing until the creditors have been paid and there is no law requiring the liquidator to keep them informed on the. The difference between the two is the.

Liquidation in economic parlance means turning things into money. Consequently GPU mining farms have been influenced although they are much less energy-intensive than bitcoin mining centers. If a fund is sold outright.

While any asset or investment can be liquidated this type of sale often refers to the process of disposing of all assets of a company that has filed for bankruptcy a legal process in which the company declares it cant pay its debts and works to settle with its creditors. Shareholders Lenders Creditors The amount that these groups will receive and the order in which they get paid will depend on the security of their claim. How long does a liquidation take.

Liquidating stocks a fancy way of saying selling stocks is a straightforward process. Liquidating a stock means selling it for cash. Liquidation stock to other companies to sell on their behalf since liquidation does not always mean the store is closing down and can give a bad public image.

A stock liquidation occurs when stock shares are converted into cash. Liquidate the existing stock means to get rid of everything or to mark down the prices of everything in stock Financial assets which can be spent are known as liquid. The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just try paying for lunch with a share of Johnson Johnson.

Liquidation preferences are expressed as a multiple of the initial investment. Answer 1 of 22. Only Liquidating Trades Are Accepted latest news Chinese crypto miners have begun disposing used graphic handling systems on secondhand market following Chinas bitcoin mining suppression.

For example you may be taxed on capital gains or lose the portfolios future appreciation. Whenever you liquidate a small portfolio or convert the stock to cash it has financial consequences. The paying of a debt.

Let S Refresh The Liquidation Basis Of Accounting Gaap Dynamics

What Is The Meaning Of Liquidation Definition Of Liquidation

Liquidating Amazon Inventory 8 Ways To Sell Off Your Stock

/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)

Cash Liquidation Distribution Overview

/liquidation-d53884bd0c01485ba4e6d20385228aa7.jpg)

/GettyImages-1005470094-d3c3108c195f40f3a1244331105e18f5.jpg)